Slide 1

Slide 2

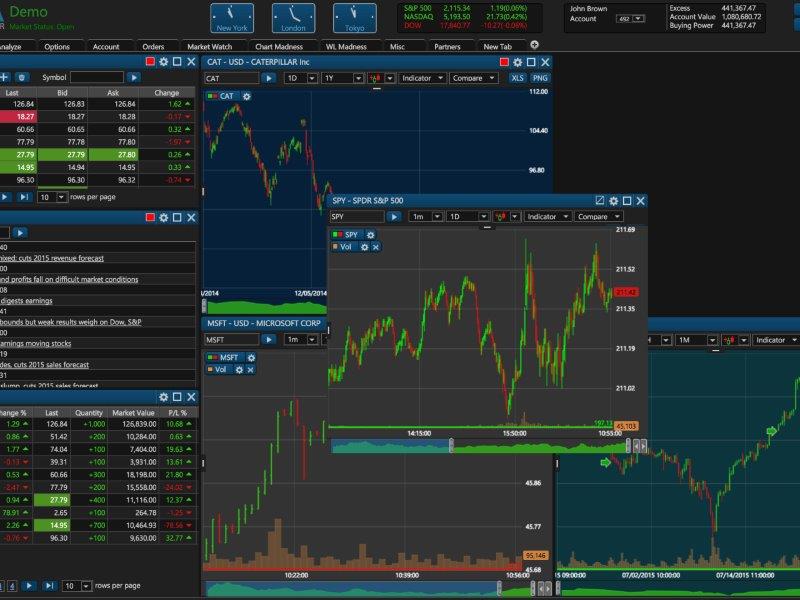

Both extended VaR and Expected ShortFall methodologies to complement VaR, SVaR, IVaR, MVaR and RNIV coverage

_____________________________________

Risk Modeling & Analytics

Slide 3

Slide 4

Slide 4

Quick Links

Menu

a one stop shop for trading and risk

“rewards are bestowed upon those who endear risk” .. sr

Contact

- 100 Church Street. Lower Manhattan, NY 10007

- 6220 Westpark Drive Suite 149, Houston, TX, 77057

- +17138519402

- +12815792210

- info@ramsrisk.com