from strategy to implementation

one stop solution

ETRM

An ETRM system stands for Energy Trading and Risk Management system. It's a specialized software platform used by energy companies (like utilities, traders, oil & gas firms, etc.) to manage the trading, risk, logistics, and settlement of energy commodities.

ETRM is Energy, Trading, Risk Management framework.

An ETRM system supports the end-to-end lifecycle of energy transactions, including:

1. Trade Capture

• Logging energy trades (power, gas, oil, emissions, renewables, etc.)

• Captures deal details like price, quantity, delivery period, counterparty

2. Risk Management

• Measures exposure to market risk, credit risk, and operational risk

• Calculates VaR, Mark-to-Market (MtM), P&L, Greeks, and stress tests

3. Scheduling & Logistics

• Manages physical delivery and nominations (e.g., gas pipeline flows or electricity schedules)

• Supports integration with TSOs (Transmission System Operators) and market operators

4. Settlements & Invoicing

• Automates invoicing and reconciliation

• Calculates financial settlements, taxes, penalties, etc.

5. Reporting & Compliance

• Supports regulatory compliance (e.g., REMIT, MiFID II)

• Generates audit trails and internal reporting

ETRM manages the following Commodities

• Electricity (day-ahead, intraday, forward)

• Natural gas

• Crude oil & refined products

• LNG (liquefied natural gas)

• Coal

• Emissions (carbon credits)

• Renewable energy certificates

Some widely used ETRM platforms include:

• Allegro

• Endur (by Openlink/ION)

• Trayport

• AspectCTRM

• Igloo (by Brady)

• EnHelix

Key business case for ETRM is the complexity of energy markets

The energy market is volatile and highly regulated. ETRM systems help:

• Manage complex pricing structures (hourly, location-based, seasonal)

• Handle both physical and financial energy products

• Mitigate risks due to price spikes, counterparty defaults, or delivery failures

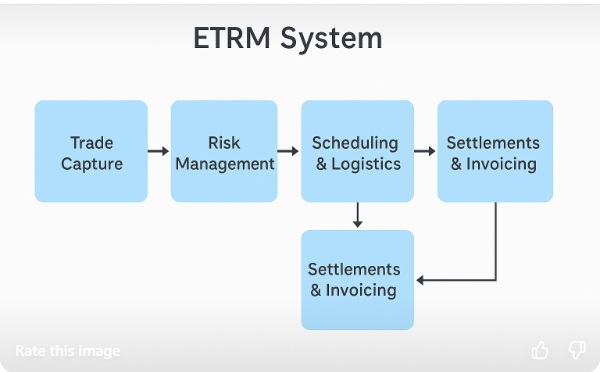

A general framework of ETRM

Primarily a comprehensive solution for an ETRM captures the major components in the life cycle of energy trading: 1. Trade Capture – where deals are logged 2. Risk Management – where exposures and risks are calculated 3. Scheduling & Logistics – handles physical flows 4. Settlements & Invoicing – processes financial outcomes 5. Reporting & Compliance – for internal and regulatory reporting Each module connects sequentially to form a full-circle solution, supporting everything from trade execution to final settlement and compliance.

There are multiple uses cases that will be explored elsewhere in this website

Quick Links

Menu

a one stop shop for trading and risk

“rewards are bestowed upon those who endear risk” .. sr

Contact

- 100 Church Street. Lower Manhattan, NY 10007

- 6220 Westpark Drive Suite 149, Houston, TX, 77057

- +17138519402

- +12815792210

- info@ramsrisk.com